Erika Riley is a journalist who has written about home design and real estate in a variety of outlets primarily in New York City. Now based in the D.C. Metro area, Erika enjoys painting her furniture too many times and finding the prettiest townhouses to walk by.

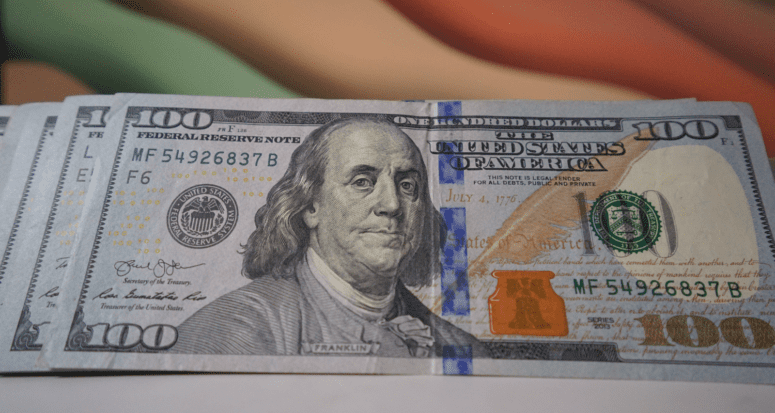

So you’ve sold your house for a profit, or are about to close on the sale. Great! But there’s one question you may still be asking: will the profits from selling your home be considered taxable income? The short answer is “sometimes.”

Often, if you’ve lived in the house for at least two years and made a profit of less than $250,000 on the house, you won’t have to worry about taxes. But if it’s been less than two years, or you sold a second home, investment property, or made a larger profit, these gains can be subject to what’s called “capital gains tax.”

Ed Kaminsky, longtime real estate agent serving the Los Angeles area, offers insight on how home sellers can strategize for those inevitable tax implications. Here are a few questions and insights you ought to want to know the answer to before recording that home sale on your tax return.

Capital gains are profits made from selling an appreciable asset, such as a house, artwork, car, or stocks. The government taxes this income, though it works a bit differently from how regular income is taxed.

Both the federal and state governments tax capital gains at a lower rate than regular income. Additionally, the government has varying tax rules for different classifications of assets. For sales of primary residences, the first $250,000 of profits are generally not taxed at all if you file your taxes as single. Similarly, if you’re married and file taxes jointly, the first $500,000 of profits from your home sale are generally not taxed.

If falling within these parameters, the home seller can qualify for the capital gains exclusion, or what the IRS refers to as the Section 121 exclusion.

Kaminsky gives an example of a single filer who originally bought a house for $600,000 and later sold it for $1 million, which would result in a $400,000 profit. There, Kaminsky explains, a single filer would likely only have to pay taxes on $150,000 of the profit, but the first $250,000 would be tax free so long as they qualify for the Section 121 exclusion.

It is also important to note that there is a difference between short-term capital gains and long-term capital gains. Short-term capital gains are profits made from selling an asset that was owned for one year or less. These profits are taxed at the same rate as ordinary income, which is typically taxed at a higher rate than long-term capital gains. So if you sell a house that you’ve owned for less than a year, the profit will likely be taxed at the same rate as your regular income.

Capital gains tax rates vary depending on your income. If you’re a single filer and make $40,400 annually or less, you will likely pay zero taxes on capital gains. The rate increases to 15% for single filers who earn between $40,401 and $445,850 per year, and 20% for single filers who earn over $445,850 per year, according to current IRS tax formulas.

Married filers who file jointly will likely pay zero taxes if their combined incomes are less than $80,800. The tax rate increases to 15% for those making between $80,801 and $501,600, and 20% for those making over $501,600.

Additionally, most states collect capital gains tax. The same rule for profits under $250,000 for single filers and $500,000 for joint filers on primary residences applies to state taxes, too. Some states, like Alaska, Florida, Nevada, Texas, and Washington, don’t collect any capital gains tax. Most of the remaining states charge at a rate between 3 and 7%; whereas California taxes capital gains at the highest rate in the country at 13.30%.

You generally only need to record your home sale on your tax return if you turned a profit of $250,000 or more as a single filer or $500,000 or more as a joint filer. In that case, you will likely be eligible to exclude the first $250,000 or $500,000 of profit and record the remaining amount on your tax return.

However, if you receive an informational income-reporting document such as Form 1099-S, Proceeds From Real Estate Transactions, you must report the sale of the home even if the gain from the sale is excludable, according to the IRS.

The exclusions on profit under $250,000 (single) and $500,000 (married and filing jointly) only apply to primary residences. To qualify, you have to have lived in the home as your primary residence for at least two of the last five years.

So, profit made from selling a rental property or a vacation home can be taxed in its entirety.

Moving into your vacation home for two years and then selling may allow you to skirt the tax, but not rental properties.

“There was a time where sellers were just moving into all their rentals and living there for two years and selling them,” Kaminsky explains. “However, the IRS did change that regulation and now states that if you move into your rental property, you have to live there for five years before it’s considered your personal [primary] residence.”

However, even if you sell your rental property before you’ve lived there as your primary residence for the allotted five years, you may be able to prorate the capital gains taxes you owe based on the years you lived in the home versus renting it. Check with your trusted tax professional for the details if you think your sale may qualify.

Also, keep in mind that you can only exclude home sale profits from capital gains tax once every two years. So if you’re selling multiple homes at the same time, you’ll only be able to exclude profits on one.

You should generally pay capital gains taxes in the quarter you sold the asset being taxed. For example, if you sold your house in February, you’d want to pay the taxes before the Q1 deadline of April 15. The deadlines for the rest of the year are June 15, September 15, and January 15 for Q2, Q3, and Q4, respectively.

This is easier than waiting until the end of the year, since you still have all of the profit in hand. Alternatively, you may be able to increase your withholding tax for the rest of the year to cover the capital gains tax.

Selling a home does come with many costs that are best to know about up front. For example, sellers will be responsible for paying the property taxes for the months they lived in the home.

Kaminsky strongly encourages sellers to keep the capital gains tax in mind when selling a house, especially if they’ve refinanced their mortgage in the past. Refinancing means that they’ve taken some of their investment out of their home, which could eat into their profit upon selling. So while the capital gain, which is calculated by subtracting the sales price of the home from the original purchase price, might be over $250,000 or $500,000, the seller might not actually have that profit in cash.

Which means they may have trouble paying their capital gains tax bill when the time comes.

Kaminsky explains, “That’s the biggest eye-opener for home sellers is when they’ve taken too much cash out of their property. That poses a real problem.”

The easiest way to avoid the capital gains tax when selling a home is to only sell primary residences, and to not sell more than one in two years. But there are other ways you may be able to lower the amount of capital being taxed on your profit.

Kaminsky recommends keeping a record of all your home improvement projects. Money you put into improving the property might qualify as a tax write-off, and can possibly be deducted from your capital gain.

”Some people are really poor record keepers, but it’s important to keep all of your receipts for all the improvements you make, and review them with your CPA to see which ones are a tax write-off,” Kaminsky comments. “That’s probably the most common mistake is not keeping track of that.”

For these and other complex tax situations, Kaminsky recommends homeowners consult with a professional tax adviser.

To summarize, here’s a good way to gauge whether and how much capital gains tax you may owe from the sale of your home:

Did you own the house and live there for at least two out of the last five years?

To find how much profit you made off your home:

To get a real-world home value estimate on your home in less than two minutes, try the HomeLight home value estimator.

A quick (and free) way to check your home value

Get a preliminary home value estimate in as little as two minutes. Our tool uses information from multiple sources to give you a range of value based on current market trends.

Header Image Source: (Blogging Guide / Unsplash)

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Erika Riley is a journalist who has written about home design and real estate in a variety of outlets primarily in New York City. Now based in the D.C. Metro area, Erika enjoys painting her furniture too many times and finding the prettiest townhouses to walk by.

Share this post