Trust Accounting 101: What You Need to Know Now

Regardless of what type of law you choose to practice, where you choose to live or what size law firm you end up starting or joining, there is one accounting feature that no lawyer is going to be able to avoid…and nor will they want to.

Trust accounting.

Understanding the benefits of trust accounting is a fundamental part of running a successful law firm, since having at least one client trust account is a common part of practicing law.

IOLTA Trust Accounting for Attorneys & Law Firms

From accurately managing client funds to maintaining ethical and legal compliance, it’s important that you have a firm grasp on the entire trust accounting process before you begin receiving client funds into your practice.

And – if you already have at least one trust account established – you already know that trust accounting can be a highly complex and often frustrating area of accounting and record keeping for your firm.

Key Takeaways

- Trust accounting is a part of the legal world that usually can’t be avoided, since most attorneys will at some time or another will receive and hold client funds for a period of time.

- In order to ensure the proper handling and protection of client trusts, specific rules and regulations have been put in place to govern these accounts, depending on where you practice.

- Good legal accounting software that specializes in trust accounts and how to correctly manage and report trust assets is an important tool to have in your law firm’s tech stack, and will make all your trust accounting significantly easier.

Whether you are a new attorney entering the legal profession for the first time, or a seasoned practitioner looking to brush up on your knowledge of what is trust accounting, it’s always going to be important that you are well-versed in the essentials of this highly sensitive and sometimes intimidating area of legal accounting.

From understanding the distinction between operating accounts and trust accounts to navigating the intricacies of trust account reconciliation, you need to have a solid foundation in trust accounting and be equipped with the knowledge and tools necessary to effectively manage client trust funds.

If you’re ready to dive into the world of trust accounting (and gain the confidence and knowledge to be able to effectively handle any client’s trust account) then let’s begin our journey into Trust Accounting 101.

What is the Definition of Trust Accounting?

Trust accounting is a specialized branch of accounting that pertains specifically to the management and handling of client funds held in trust by law firms.

It involves the diligent and accurate tracking of client funds received for various purposes, such as retainers, settlements, or disbursements.

The primary objective of trust accounting is to ensure the safeguarding of client funds, maintain transparency, and comply with legal and ethical obligations.

In legal trust accounting basics, the focus is on distinguishing between two main types of accounts: the operating account and the trust account.

One easy way to distinguish between these two types of bank accounts is to remember that an operating account holds the law firm’s own funds for business expenses and operational costs, while the trust account holds funds that belong to clients and should always be held separately from the firm’s assets.

A trust fund can be a pooled trust account and hold funds for a number of clients in one account (check out some of our articles on IOLTA accounts for more on this.)

But regardless of whether or not a trust account is for one client or many, these trust funds must be used exclusively for the purpose for which they were intended, and the law firm has a fiduciary duty to protect and accurately account for any money that is deposited or withdrawn from them.

Schedule a demo

Trust accounting also involves meticulous record-keeping and documentation. Law firms must maintain detailed records of all transactions involving client trust funds, including deposits, withdrawals, and transfers.

These records should be up-to-date, accurate, and readily accessible for auditing and reporting purposes.

Compliance with legal and regulatory requirements is of utmost importance in attorney trust accounting to ensure the protection of client funds and maintain the integrity of the legal profession.

By making sure that their firm has adequate and accurate trust fund practices in place, a law firm can show their commitment to ethical conduct, build trust with their clients, and safeguard the reputation of their law firm as a whole.

What are the Most Important Aspects of Trust Accounting?

Let’s break down some of the most important aspect of trust accounting and why it matters to your law firm:

- Segregation of Funds: One of the fundamental principles of trust accounting for law firms is the clear segregation of client funds from the law firm’s own funds. This ensures that client funds are held separately and not commingled with the firm’s assets.

- Accurate Record-Keeping:Trust accounting for lawyers requires meticulous record-keeping to track all transactions involving client trust funds. This includes detailed documentation of deposits, withdrawals, transfers, and any interest earned on client funds. Accurate record-keeping is crucial for accountability and transparency.

- Compliance with Legal and Ethical Obligations: Trust accounting must adhere to applicable legal and ethical guidelines. This includes trust accounting compliance with jurisdiction-specific regulations, maintaining proper financial controls, and meeting reporting requirements. Adhering to these obligations protects the interests of clients and upholds the integrity of the legal profession.

- Regular Reconciliation: Reconciling trust accounts is a crucial aspect of trust accounting. It involves comparing the records of the trust account with bank statements to ensure that the balances match. Regular reconciliation helps identify discrepancies, errors, or potential fraudulent activities, ensuring the accuracy of client trust accounting records.

What Happens if My Law Firm is Not in Compliance with Trust Accounting Rules?

One of the biggest concerns of law firm trust accounting are the consequences that can result if there is a failure to comply with the rules surrounding it.

Here are some potential outcomes if a firm is non-compliant with the trust accounting rules and regulations in their area:

- Ethical Violations:Rules for trust accounting are designed to protect the interests of clients and maintain the integrity of the legal profession. Non-compliance can lead to ethical violations, damaging the reputation and credibility of the law firm. Ethical violations may result in disciplinary actions, including professional sanctions, fines, or even license suspension or revocation.

- Legal Liability: Non-compliance with trust accounting rules can expose law firms to legal liability. If client funds are mishandled or misappropriated, clients may file legal claims against the firm for breach of fiduciary duty or negligence. These claims can lead to costly lawsuits, potential financial settlements, or damage to the firm’s professional standing.

- Financial Losses: Improper trust accounting practices can result in financial losses for both the law firm and its clients. Commingling client funds with the firm’s operating funds or failing to maintain accurate records can lead to errors, discrepancies, or even the loss of client funds. Financial losses can impact the firm’s financial stability, client trust, and long-term viability.

- Regulatory Penalties: Regulatory bodies overseeing legal practice often have strict guidelines and regulations related to trust accounting. Non-compliance can result in penalties and fines imposed by these regulatory authorities. These penalties can be significant and can further damage the firm’s reputation and financial standing.

- Reputational Damage: Trust and reputation are crucial for law firms. Non-compliance with trust accounting rules can lead to reputational damage, affecting the firm’s ability to attract and retain clients. Negative publicity, client complaints, or legal disputes related to trust accounting can tarnish the firm’s image and make it challenging to rebuild trust in the legal community.

Implementing robust internal controls, utilizing software for trust accounting, conducting regular audits, and providing ongoing training to staff members can help ensure compliance and protect the firm’s reputation, financial well-being, and client relationships.

Trust Accounting: How to Choose the Right Software for You

Staying accurate and in compliance with your firm’s trust accounting needs doesn’t have to be difficult if you’ve taken the time to do your research and have implemented the type of software that is specifically designed for legal trust accounting:

Here’s some simple steps to keep in mind:

- Look for software specifically designed for trust accounting.

- Ensure it supports trust account management, including deposits, three-way reconciliation, disbursements, and transfers.

- Verify that it provides features for trust reconciliation and accurate tracking of trust fund balances.

- Choose software that complies (or can be customized to comply) with trust accounting regulations specific to your jurisdiction.

- Ensure it helps prevent common trust accounting errors and provides safeguards against fund commingling.

- Look for software that generates reports required for trust accounting compliance.

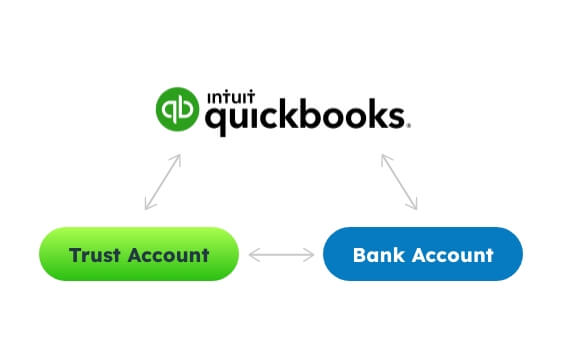

- Check if the software integrates seamlessly with your existing accounting systems, such as QuickBooks for trust accounting.

- Verify compatibility with your operating systems (Windows, macOS, etc.) and consider whether it is cloud-based or on-premises software.

- Prioritize software that offers robust security measures to protect sensitive client information and trust fund data.

- Ensure the software includes features like user access controls and data encryption.

- Evaluate the quality and availability of customer support from the software provider.

- Consider whether training and resources are provided to help your staff effectively use the software and stay up-to-date with change in the legal industry standards.

Remember that thoroughly researching and evaluating multiple trust accounting software for lawyers will help you to find the one that best aligns with your law firm’s specific trust accounting requirements and preferences.

LeanLaw: Trust Accounting Software…and so much more!

When you decide it’s time to take a good look at the trust accounting software your firm is using, rather its something made in house or QuickBooks trust accounting, LeanLaw is an excellent choice for you to consider.

LeanLaw offers comprehensive trust accounting features that are specifically tailored for law practices.

With LeanLaw, you can easily manage client trust funds, including deposits, disbursements, transfers, and reconciliation. The software ensures compliance with trust accounting rules and regulations, reducing the risk of errors and non-compliance.

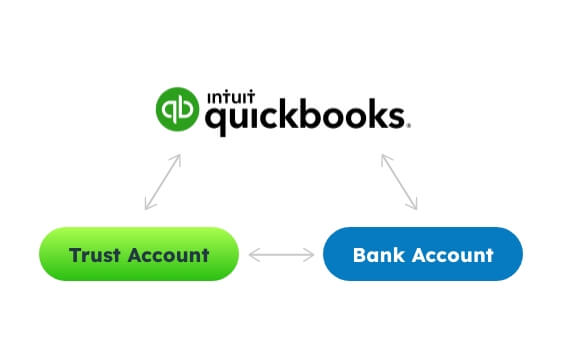

Three-way reconciliation

Bank accounts, trust accounts and QuickBooks Online are in continuous sync and in-line with state bar standards, so you are well positioned for your weekly or monthly three-way reconciliation. That’s less time spent on your law firm’s end.

One of the standout features of LeanLaw is its seamless integration with trust accounting QuickBooks Online, a widely used accounting software. The three-way reconciliation feature allows for smooth synchronization of financial data between the two platforms, providing a holistic view of your firm’s financials. It eliminates the need for manual data entry and streamlines your accounting processes.

LeanLaw’s user-friendly interface and intuitive workflow also make it easy to navigate and understand, even for users who are not accounting professionals.

It simplifies the complex process and makes it accessible to legal practitioners who may not have extensive accounting knowledge.

Finally, one of the best features of LeanLaw is its dedication to customer support and training resources. As a software platform that was created by legal professionals, the LeanLaw team is readily available to address any questions or issues you may have.

Whether you are a single-user practice or a multi-office firm, LeanLaw trust accounting software can scale to meet your practice’s particular requirements.

Want to learn even more? Reach out to LeanLaw for a free demo today!

Get started with LeanLaw

Discover how the LeanLaw’s accounting tools automate the trust accounting process in a few simple clicks and get started with your law office.